QuickBooks

Maxio’s QuickBooks Integration Streamlines Accounting for Subscription Businesses

Maxio and QuickBooks work together to automate the order-to-cash workflow for SaaS and subscription businesses.

Are you using QuickBooks as a general ledger (GL)? Then the following scenario will sound familiar: It’s time to close out the month, but you’ve been putting it off due to the sky-high stack of manual journal entries you have to complete.

Why connect QuickBooks to Maxio?

By connecting QuickBooks Online to Maxio, you can:

- Automate accounting workflows

- Reduce reconciliation times

- Save the finance department countless hours every month

How it works

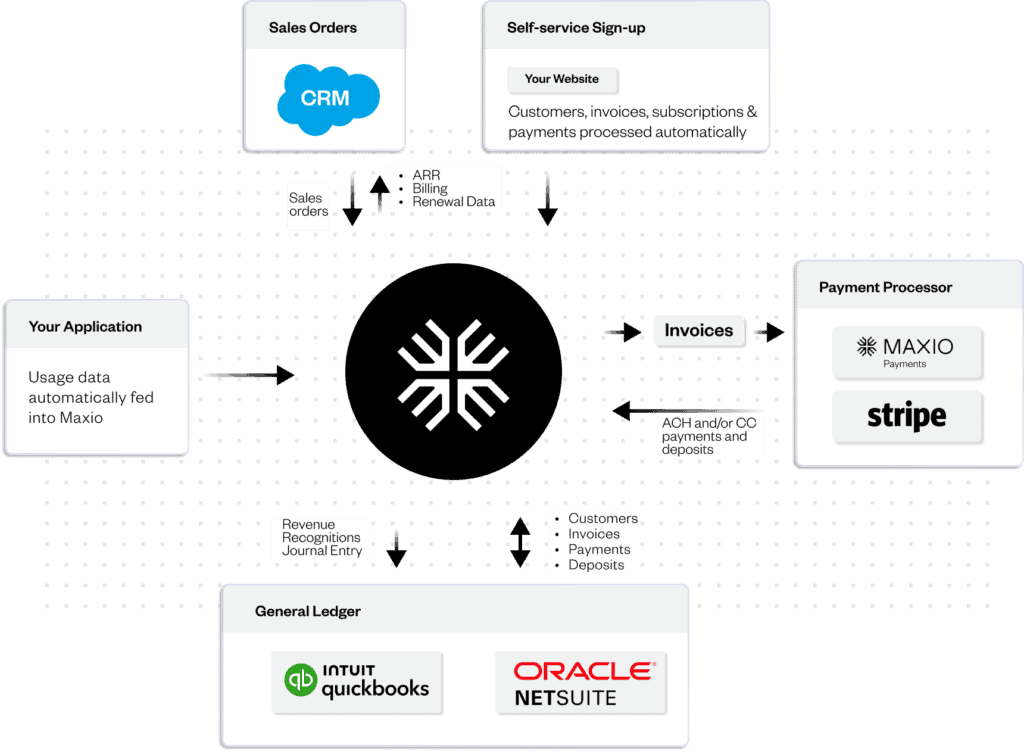

Maxio is a financial operations platform for B2B SaaS companies that offers services for billing, subscription management, revenue recognition, and SaaS metrics & analytics.

Once a sales order is processed (either manually or automatically through a CRM), that sales order data flows into Maxio where the appropriate customer, contract, transaction, invoicing, and payment records are created.

From there, Maxio automates billing schedules and collections efforts, as well as revenue recognition schedules and SaaS metrics.

Maxio maps to your Chart of Accounts in QuickBooks, so you know Revenues are being booked to the appropriate place automatically.

At the end of the month, Maxio generates a consolidated journal entry that is then recorded in QuickBooks’ General Ledger.

Product Details

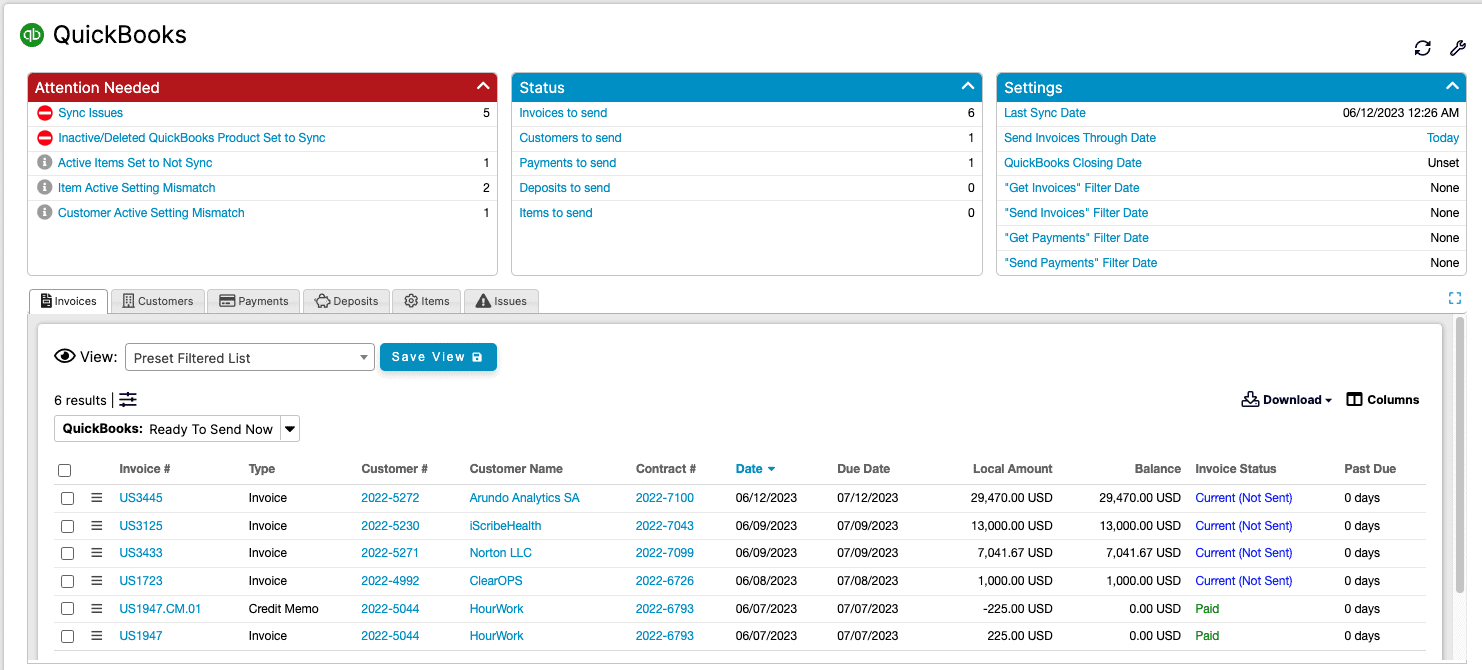

| Key data objects | |

|---|---|

| Chart of Accounts | The Chart of Accounts is synced from QuickBooks to Maxio and is typically managed only in QuickBooks. |

| Items | Parameters are set to determine whether Invoice Line Items that use an Item are to sync, and they define the default revenue recognition method and billing method for Transactions that use the Item. |

| Invoices | Invoices are typically created in Maxio Platform by combining Invoice Line Items from one or more Transactions within a single Contract. |

| Credit Memos | You create a Credit Memo in Maxio Platform by adding Invoice Line Items with negative values, which can be accomplished by creating one or more Transactions with negative amounts. If the total of the line items is negative, Maxio Platform will sync a Credit Memo to QuickBooks. |

| Payments | Syncing deposits to QuickBooks means you do not have to manually enter individual payments and expenses into QuickBooks, which can save countless hours. Instead, you can simply match the deposit record to a bank transaction in your QuickBooks file/account. |

| Refund Receipts | A Refund Receipt is used by QuickBooks users to record a refund to a customer for a previously paid balance on an Invoice. The preferred way to create a Refund Receipt is directly from the original invoice in Maxio Platform that you wish to refund against, but you can also create a Refund Receipt in QuickBooks and sync it into Maxio Platform. |

Link Backs and auditability

In Maxio, there are convenient linkbacks for various record types, making it easy to navigate between systems and provide audit samples quickly.

Sales tax

Sales tax can either be calculated in Maxio via our integrations with AvaTax or Anrok, or with QuickBooks’ tax services.

Multi-currency

Both QuickBooks and Maxio are able to support multi-currency. By enabling QuickBooks’ multi-currency setting, all synced customers and sales receipts will use the same currency as the originating Maxio instance.

Availability and pricing

Maxio’s QuickBooks integration is available to all Maxio customers and is included in our base plan.

If you have any specific questions, don’t hesitate to reach out to support@maxio.com.